Introduction

What if the number you’ve been planning your entire future around is completely wrong? That’s exactly what happens to most investors who rely on old mutual fund calculators — the ones that happily show ₹1 crore without telling you that inflation, taxes, and expenses will quietly cut that number in half.

In 2025, using a mutual fund calculator isn’t just about seeing “how much you’ll get.”

It’s about understanding what your money will actually be worth in today’s terms — and avoiding the false hope that comes from unrealistic 15–18% return assumptions.

Whether you’re investing for retirement, your child’s college fund, or just starting a monthly SIP, the right calculator can give you clarity in seconds.

The wrong one can mislead you for years.

This article will show you how to use a mutual fund calculator the correct and realistic way, so you can plan with confidence, avoid common traps, and build wealth with zero guesswork.

Key Takeaways

- Most free calculators show 3–6% higher growth because they skip inflation and tax.

- An extra 1% expense ratio can quietly eat away ₹30–50 lakh over 25–30 years.

- The safe return to put in your calculator today is closer to 11–12%, not 15%.

What Is a Mutual Fund Calculator and Why You Need One

Imagine your friend Raj puts ₹10,000 every month in mutual funds for his daughter’s college. Ten years later, he opens the statement and feels shocked: it’s nowhere near the ₹2 crore the old calculator promised. Sound familiar?

A mutual fund calculator is a free online tool that tells you how much your money can grow if you invest regularly (SIP) or in one go (lump-sum). It’s like a crystal ball, but only if you feed it the right numbers.

Difference between SIP calculator and lump-sum calculator

- SIP calculator → for monthly investments (what 90% of Indians use)

- Lump-sum calculator → for one-time big amounts (bonus, inheritance, sale of property)

Core inputs every good calculator asks for

- How much you’ll invest (monthly or one-time)

- How many years will you stay invested

- Expected yearly return (this is the part everyone fights over)

- Sometimes: step-up percentage, inflation, expense ratio

Behind the scenes, it just uses the same compound interest formula you learnt in school — just repeated every month for SIPs.

Types of Mutual Fund Calculators Available in 2025

Not all calculators are made equal. Here’s what you’ll find today:

- Basic ones (Groww, Moneycontrol, ClearTax) → super fast, but ignore inflation and tax

- Smarter ones (ET Money Genius, Value Research Premium) → let you add 6–7% inflation and the new 12.5% tax

- Goal-based planners → tell you “how much SIP for a ₹5 crore retirement”

- New AI tools → run 10,000 market scenarios (Monte Carlo) to show best-case and worst-case

How to Use a Mutual Fund Calculator Correctly (Step-by-Step)

Let’s do it together like we’re having chai.

- Decide on SIP or lump-sum.

- Enter your monthly amount or one-time amount.

- Choose how many years (longer = more magic).

- Put expected return — we’ll talk about realistic numbers soon.

- Turn on inflation (6.5%) if the tool has it.

- Add expense ratio (0.6–1% for direct plans).

- Add step-up % if your salary increases every year (most people put 8–10%).

- Hit calculate and look at BOTH numbers: total value and “today’s money” value.

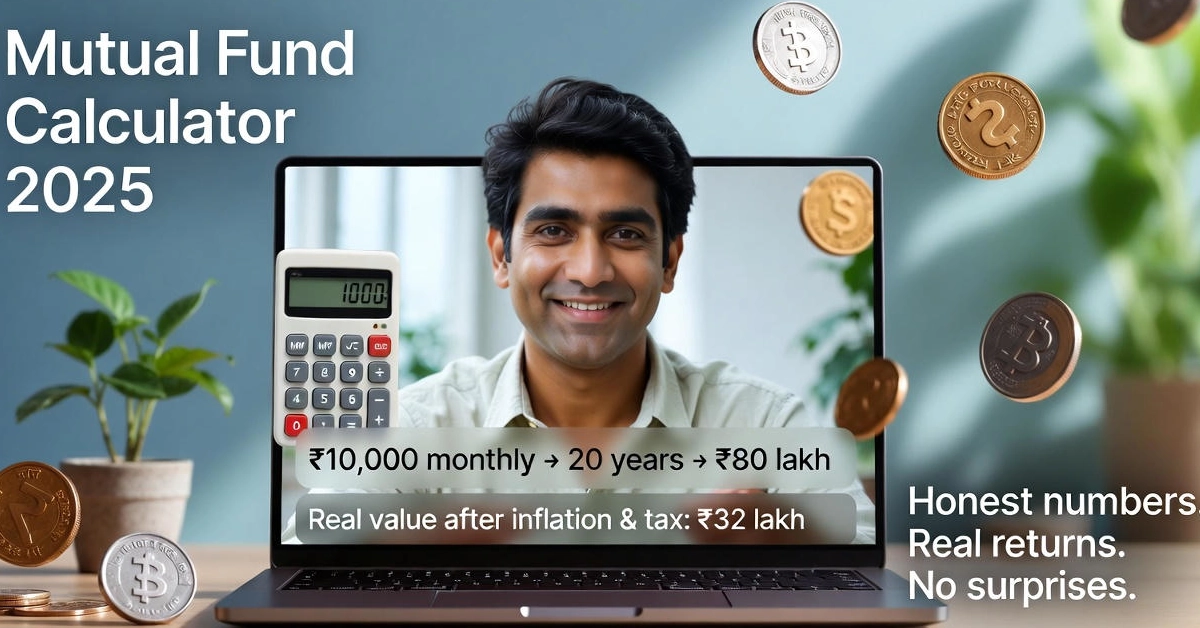

Real example 1: Neha, 28, starts a ₹10,000 monthly SIP for 20 years. At 12% return → ₹80 lakh total, but only ₹32 lakh in today’s money after inflation. That ₹32 lakh is the honest number she should plan with.

Real example 2 Amit puts ₹10 lakh lump sum for his son’s education in 12 years. At 11.5% (average flexi-cap return) → ₹36 lakh total, ₹18 lakh in today’s money.

How to Choose Realistic Expected Return Rates in 2025

This is where most people mess up big time.

Everyone remembers 2014–2021 when large-cap funds gave 15–18%. Those days are over for the next decade. After the 2022–2024 corrections and high valuations, experts say:

- Large-cap funds → 10–12% long-term

- Flexi-cap/multi-cap → 11.5–13%

- Mid-cap → 12–14% (with bigger ups and downs)

- Small-cap → 13–15% (only if you can sleep through -40% drops)

- Debt/hybrid → 7–9%

Safe rule for 2025–2035: Use 12% if you pick good diversified equity funds and stay 15+ years.

Hidden Factors Most Calculators Ignore (The Painful Truth)

These are the silent killers:

- Inflation → ₹1 crore in 2045 will feel like ₹35–40 lakh today at 6.5% inflation.

- Tax → New 12.5% LTCG tax above ₹1.25 lakh gains per year. It reduces your final corpus by 8–12%.

- Expense ratio → Direct plans charge 0.5–0.8%, regular plans 1.5–2%. That 1% difference can cost ₹40–50 lakh over 30 years.

- Market crashes → Calculators assume a smooth 12% every year. Real life gives -30% one year and +40% the next — long-term average still works, but the ride is bumpy.

Quick math: 1% higher expense ratio over 30 years on ₹10,000 monthly SIP = ₹48 lakh less in your pocket.

Best Mutual Fund Calculators in India 2025 (My Personal Ranking)

- ET Money Genius → Best overall (inflation + tax + step-up built-in)

- Value Research Premium → Most accurate historical data

- Groww → Fastest and simplest for beginners

- Advisorkhoj → Great for lump-sum + dividend options

- Moneycontrol → Good when you want to compare 5 funds side-by-side

Mutual Fund vs FD vs PPF vs Direct Stocks

(₹5,000 monthly for 15 years, post-tax & inflation-adjusted)

| Option | Total Value | Today’s Money Value | Safety |

|---|---|---|---|

| Equity Mutual Fund (12%) | ₹19–21 lakh | ₹7.5–8.5 lakh | Medium |

| Bank FD (7%) | ₹13 lakh | ₹5.2 lakh | Very High |

| PPF (7.1%) | ₹13.5 lakh | ₹5.4 lakh | Very High |

| Direct Stocks (13–14%) | ₹23–26 lakh | ₹9–10 lakh | High Risk |

Mutual funds win on growth, but only if you stay invested through the ups and downs.

Common Mistakes That Make Your Calculation Completely Wrong

From hundreds of Reddit and Twitter threads, these are the top 10 mistakes I see every day:

- Putting a 15–18% return just because “it happened before”

- Forgetting to switch on inflation

- Using the regular plan expense ratio instead of the direct

- Starting the clock from today, but planning to withdraw in 2040 without inflation

- Thinking the big number on top is what you’ll actually spend

- Stopping SIP when markets fall 20%

- Believing “past 10-year returns = future returns” guarantee

- Not increasing SIP when salary increases

- Using a calculator once and never checking again

- Taking loans against mutual funds and killing compounding

Pro Tips to Get Super Accurate Projections

- Use 11–12% for equity funds, not more.

- Always turn on 6.5% inflation.

- Use direct plans only (save 0.8–1% every year.

- Add 8–10% step-up if your income grows.

- Revisit your calculation every 2–3 years.

- Choose flexi-cap or multi-cap funds — they adjust automatically.

- Keep an emergency fund in FD so you never stop SIP.

- Start today — even ₹2,000 monthly beats waiting for the “perfect” time.

Start Calculating Your Own Numbers Right Now

Take 30 seconds and try this free calculator that already has realistic defaults built in: → ET Money Genius Calculator (my favourite) → Value Research SIP Calculator

Put your real numbers, turn on inflation and tax, and see the honest truth. The best time to start was 10 years ago. The second-best time is today.

Conclusion

Using a mutual fund calculator the right way can mean the difference between planning with honest numbers and getting shocked years later. When you include realistic returns, inflation, tax, and expense ratios, your projections become far more accurate. Whether you’re investing through SIPs or a lump sum, the key is simple: start early, stay consistent, and review your plan every few years. With the right inputs and the right tools, your money can grow quietly and powerfully in the background.

Start today — your future self will thank you.

FAQs about the Mutual Fund Calculator

- What is a mutual fund calculator? A mutual fund calculator is an online tool that estimates how much your SIP or lump-sum investment can grow over time based on returns, duration, and other factors.

- What return rate should I use in 2025? For 2025–2035, use 11–12% for diversified equity funds. Using 15–18% is unrealistic and leads to inflated expectations.

- Should I include inflation in my calculation? Yes. Always add 6.5% inflation to see the true value of your future money in today’s terms while using the mutual fund calculator.

- Do taxes affect mutual fund returns? Yes. The 12.5% LTCG tax reduces final returns by around 8–12%, especially on long-term SIPs.

- Which mutual fund calculator is best in India? ET Money Genius (best overall), Value Research (most accurate), and Groww (simplest) are the top mutual fund calculator 2025 options.